florida estate tax exemption 2020

500 Civilian or 5000 Ex-Service Member Disability Exemption. Qualifying homeowners can get a tax exemption up to 75000 for their primary residence.

Does Florida Have An Inheritance Tax Alper Law

That tax is paid to the local Florida municipality.

. State Sales Tax Exemption. Applicants who timely file by March 1 possess title to the real property and are bona fide Florida residents living in the dwelling and making it their permanent home as of January 1 qualify for the exemption. Minnesota law also allows married couples to use ABC Trust planning to defer the payment of all estate taxes until after the second spouses death.

500 Widows or Widowers Exemption. Eskamani D-Orlando sponsored the House bill calling for tax-free diapers and convinced the House to add it to the tax relief package at. Florida has 993 special sales tax jurisdictions with local sales taxes in addition to the.

However as the exemption increases the minimum tax rate also increases. To file for the additional Widows or Widowers exemption you must be a widow or widower prior to January 1 of the tax year and bring proof of your spouses death. Jan 15 2020 Heartland Institute is an associate.

B The tax exemption carries over to the benefit of the veterans surviving spouse as long as the spouse holds the legal or beneficial title to the homestead permanently resides thereon as specified in s. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. This is sometimes called the two-year rule The Use Test.

This is a tax paid on the profits that you make on the sale of your Florida. A tax is also levied on notes bonds mortgages liens and other written obligations to pay that are filed or recorded in Florida. According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year.

Provide a copy of the Consumers. 196031 and does not remarryIf the surviving spouse sells the property an exemption not to exceed the amount granted under the most recent ad valorem tax roll may be. Trying to work around these laws is tax fraud.

Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. To qualify for the home sale capital gains tax exemption you must pass the use test looking at.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The second tax to be aware of is the capital gains tax. Laws designed to protect the value of a home from property taxes and creditors following the death of a homeowner spouse.

Learn more Heartland Institute - Global Energy Monitor. Divorced persons do not quality for widows or widowers exemption. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value.

It is a transfer tax not an income tax. You can only qualify for the home sale exemption from the capital gains tax once every two years. Additional exemptions are available for.

Groceries and prescription drugs are exempt from the Florida sales tax. The rate for these types of contracts is 35 cents per 100 of value. Ordinary monetary and property gifts are unlikely to be impacted by this tax since the yearly limit for 2021 is.

Complete Florida Hotel Tax Exempt Form online with US Legal Forms. In the year after the property receives the homestead exemption or 1995 whichever is later the property appraiser reassesses the. In general Medicaid is empowered to act as a creditor of a recipients estate allowing the Florida Medicaid Estate Recovery Program to seek reimbursement by filing a claim against estate assets.

Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies. A Florida recipients primary residence is exempt from Medicaid reimbursement but non-homestead real estate in Florida such as for instance a. Call Florida National Title At 561-408-0729 To Discuss Buying Or Selling Porperties.

We Can Help You With Any Real Estate Related Questions. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. Counties and cities can charge an additional local sales tax of up to 15 for a maximum possible combined sales tax of 75.

The estate tax exemption was then increased in 200000 increments to reach 3 million in 2020. Easily fill out PDF blank edit and sign them. Exemption Limited to Every Two Years.

Qualifying homeowners can deduct 39300 for 2019-2020 from the assessed value of the applicants home and property taxes are computed based upon the remaining assessment Louisiana. The first is the property tax. A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds.

A homestead exemption can be found in state statutes. Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. Holly Unck a vice president of transaction tax services in real estate brokerage CBRE Groups Phoenix office wrote in a spring 2020.

![]()

Does Florida Have An Inheritance Tax Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Attorney For Federal Estate Taxes Karp Law Firm

How The U S Taxes Estates And Heirs And What May Change Estates Palm Beach America

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Strategies For Gifting Money And Assets In An Estate Plan Deloach Hofstra Cavonis P A

Florida Estate Planning Guide Everything You Need To Know

Inheritance Tax In Florida The Finity Law Firm

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

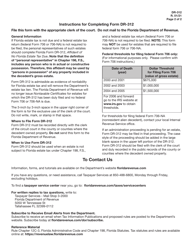

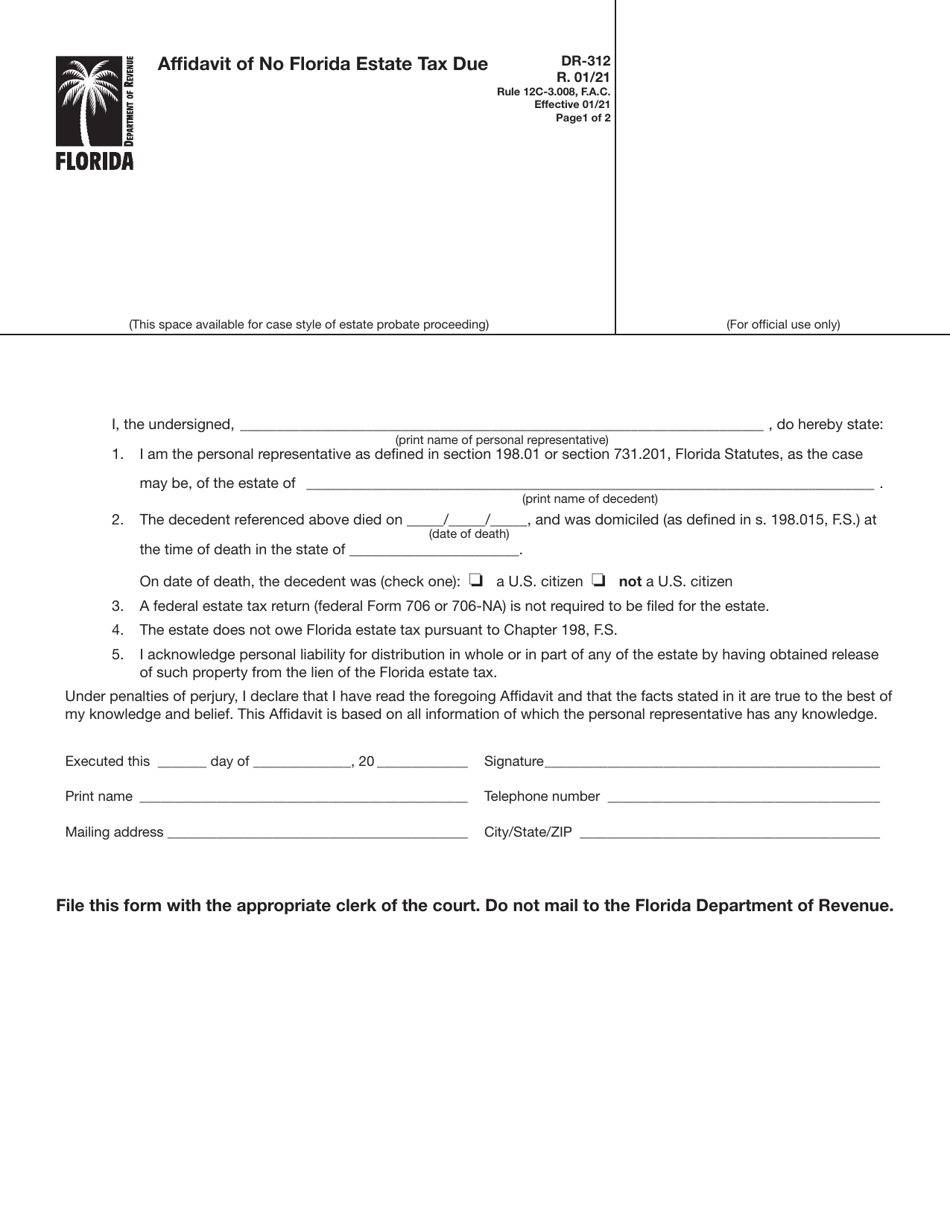

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Does Florida Have An Inheritance Tax Alper Law

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Eight Things You Need To Know About The Death Tax Before You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

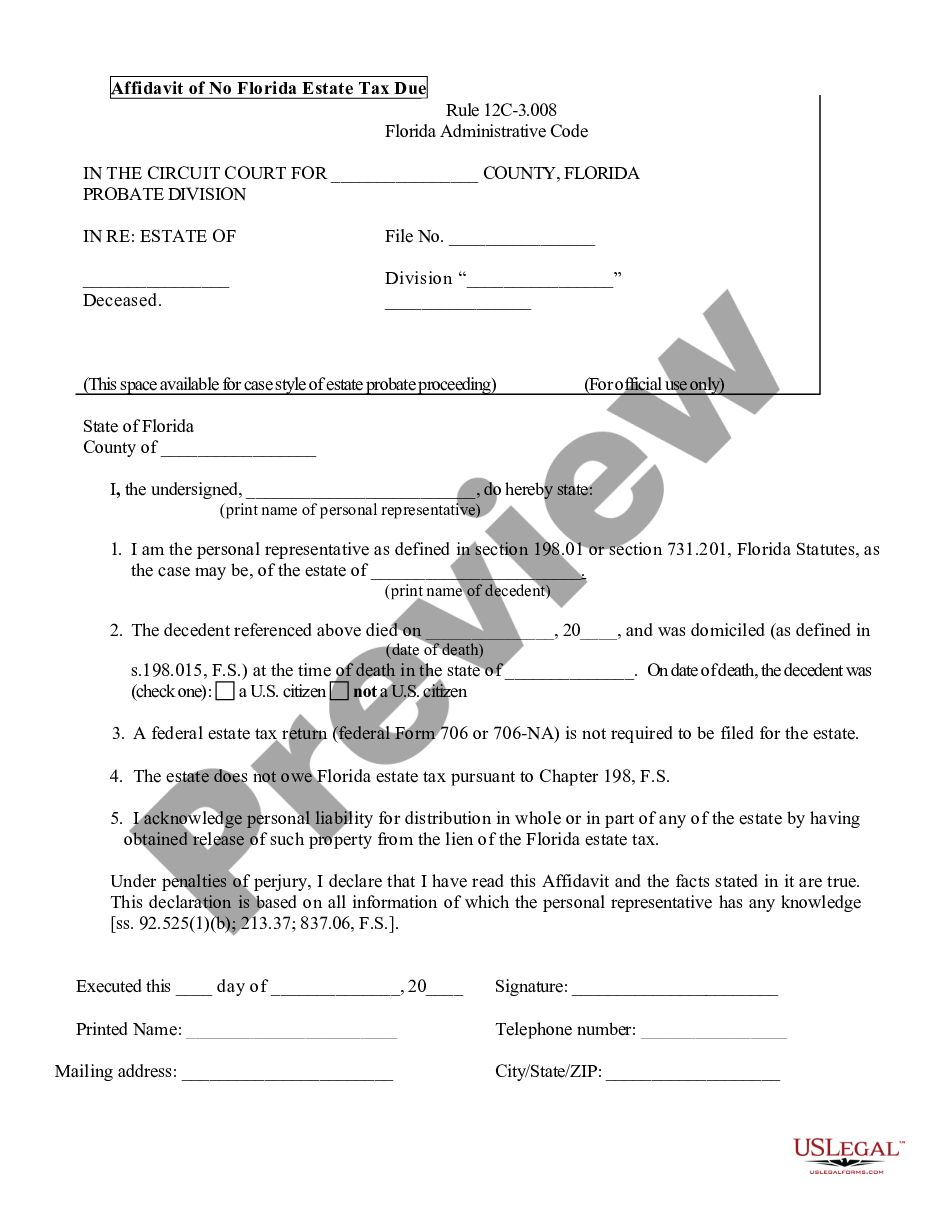

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller